IN HIS BOOK, the Big Rich, Bryan Burrough recounts a conversation when the legendary Texas oil man Clint Murchison was in the middle of the Great Depression with debt ballooning to over $4 million, far more than his net worth. “Aren’t you concerned about owing all this money you can’t pay? Ernest Closuit asked him. “No,” Murchison said with a smile. “If you’re gonna owe money, owe more than you can pay, then the people can’t afford to foreclose.”

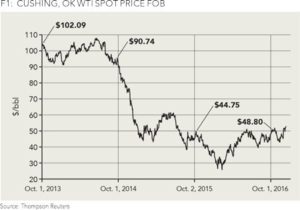

One of the main lending sources in oil and gas is a Reserves-Based Loan (RBL). This loan https://www.picoupons.com/bonus-slot-new-member-di-awal/ is a line of credit generally extended by a syndicate of banks collateralized or backed by a company’s oil and gas reserves. In the simplest form, oil reserve value is the cash flow from future expected production times the price of oil. These cash flows are then discounted back to give a net present value, often PV10. The amount of collateral the loan is based on is called the borrowing base, which in its simplest form is the reserves PV10 times a risk factor times an advance rate. The risk rate for proved producing (PDP) wells on production is often around 95% and proved undeveloped (PUD) or new drill locations 50%. The advance rate for how much value can be used as collateral is often 65%. Traditionally, a company will have its borrowing base reviewed twice a year-in the Spring and Fall-to set the amount or credit line available on the loan. These loan values are fundamentally a percentage of PV of the production times the price. However, despite a 75% contraction in oil prices from 2014 to 2016 (see Figure 1) many of these loans were not reduced in 2015, 2016, or 2017. To many of us, this math just doesn’t work.

By Laura Freeman, Oil and Gas Financial Journal