The Opportunity

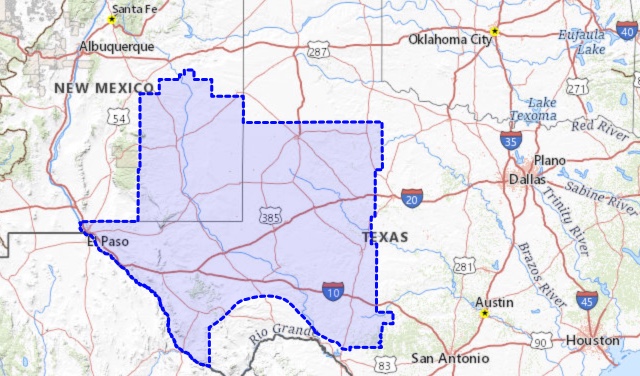

Acquiring water infrastructure assets servicing energy production in the Permian Delaware Basin from a distressed seller at a valuation of 2x – 3x Pro Forma Free Cash Flow.

Project Rustler is raising $20MM in Preferred Units for acquisition and capital improvements.

Transaction

Project Rustler is acquiring Salt-Water Disposal (“SWD”) infrastructure located in the Permian Delaware Basin consisting of 6 operational SWD wells, 3 additional SWD wells have been drilled and permitted, asset includes 39 miles of pipeline and electrical infrastructure. Seller invested $60MM in the asset. Purchase price of the assets is $10MM (Adj.). Seller is disposing of assets to raise cash for revolver paydown.

Business Description

Project Rustler offers salt-water disposal services to energy producers in the Permian Delaware Basin. Company charges $0.80 to $1.20 per barrel of salt-water disposed with current capacity of 90k BW/d, and a forecasted capacity of 135k BW/d when previously drilled uncompleted wells come online. Within a 15-mile radius of Project Rustler SWDs, 1.9MM BW are produced daily by tier 1 producers: EOG, Concho, COP, CVX, BP, Cimarex.

Management

Project Rustler’s management team has over 80+ years combined experience in energy, marketing and management of public companies. The principals have successfully managed oil and gas and related services, including salt-water disposal for the majority of their careers.

Financials

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| $ Per Brl | $0.90 | $0.93 | $0.96 | $0.99 | $1.02 |

| Water - Bpd | 23,750 | 61,250 | 95,000 | 110,000 | 110,000 |

| Revenue (MM) | $8,834.33 | $22,504.43 | $35,694.15 | $42,446.85 | $43,654.65 |

| EBITDA | $5,536.53 | $17,906.51 | $29,922.75 | $36,153.90 | $37,361.70 |

| CAPEX | $(7,311.86) | $(1,416.52) | $0.0 | $0.0 | $0.0 |

| Net FCF | $(1,775.33) | $16,490.99 | $29,922.75 | $36,153.90 | $37.361.70 |

Security Offering Return Profile

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| $ Per BW | $0.90 | $0.93 | $0.96 | $0.99 | $1.02 |

| Pref. Distributions | $2,000.00 | $2,000.00 | $2,000.00 | $2,000.00 | $2,000.00 |

| EBITDA | $5,536.53 | $17,906.51 | $29,922.75 | $36,153.90 | $37,361.70 |

| Multiple | 7.0X | 7.0X | 7.0X | 7.0X | 7.0X |

| Enterprise Value | $38,755.70 | $125,345.60 | $209,459.20 | $253,007.30 | $261.531.90 |

| ( - ) Pref. Units | (20,000.00) | (20,000.00) | (20,000.00) | (20,000.00) | (20,000.00) |

| ( + ) Cash | $4,724.70 | $19,214.70 | $47,137.40 | $81,291.30 | $116,653.00 |

| Equity Value | $23,480.40 | $124,560.20 | $236,596.60 | $314,368.60 | $358,184.90 |

| % of Upside | $2,348.00 | $12,456.00 | $23,659.70 | $31,436.90 | $35,818.50 |

| Dollar Return | $$4,348.00 | $16,456.00 | $29,659.70 | $39,436.90 | $45,818.50 |

| Adj. Cost Basis | $11,637.50 | $11,637.50 | $11,637.50 | $11,637.50 | $11,637.50 |

| Multiple on Cost | 0.4X | 1.4X | 2.5X | 3.4X | 3.9X |

| IRR | NA | 22.50% | 53.66% | 63.41% | 66.62% |

Preferred Units with a 10% annual distribution, 10% profit share on upside.

Favorable tax status with the ability to write-off 80-90% of the investment in 2020.

Proprietary and Confidential.

Disclaimer

The performance represented is historical; past performance is not a reliable indicator of future performance. EPUS Global Energy, LLC, Fund H20, LP and or its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.