Can an individual invest in water… and should they?

- July 6, 2023

- EPUS Global Energy

- News

The first step to understand an investment’s risk is to analyze the process from which the upside of the investment is...

U.S. rig count declines for fourth week while Permian, Texas counts increase

- May 31, 2023

- EPUS Global Energy

- News

U.S. count of active drilling rigs fell for the fourth consecutive week, but the counts in Permian Basin and Texas reversed...

Conference highlights produced water innovation in oil and gas industry

- May 12, 2023

- EPUS Global Energy

- News

“Our conversations this year focus on reuse of produced water, and then the cleanup concentrations that you have to reach to...

Fracking Waste Gets a Second Look to Ease Looming West Texas Water Shortage

- May 12, 2023

- EPUS Global Energy

- News

Fracked wells in West Texas don’t just produce petroleum. Much more than anything else, they spit up salty, mucky water. Typically,...

Unconventional Plays: Water Management’s Evolution and Forecast

- January 12, 2023

- EPUS Global Energy

- News

Before 2012, water management for unconventional oil and gas plays was in its infancy and was trying to keep up with...

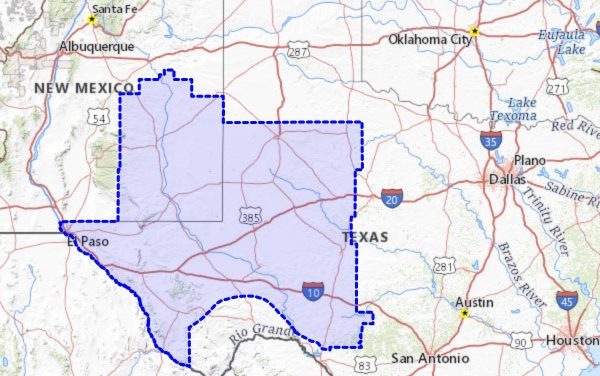

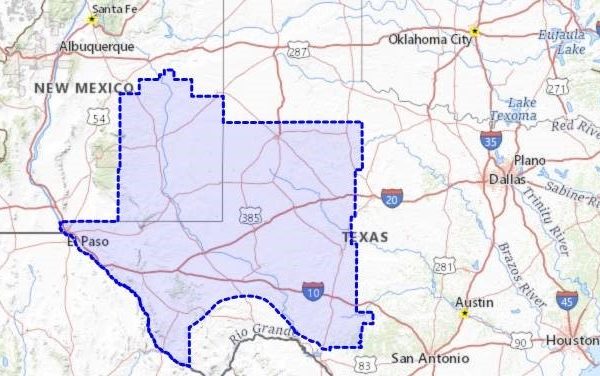

The great saltwater flood in the Permian Basin

- August 8, 2022

- EPUS Global Energy

- News

The Permian basin (Permian) of Texas (TX) and New Mexico (NM) is the most prolific oil and gas region in the...

Total recoverable oil worldwide is now 9% lower than last year, threatening global energy security

- July 3, 2022

- EPUS Global Energy

- News

Following publication of BP’s annual Statistical Review, each year Rystad Energy releases our own analysis of the global energy landscape to...

Rig counts pause with 342 in Permian, 357 in Texas, 727 in U.S.

- June 12, 2022

- EPUS Global Energy

- News

Oil and gas operators in Permian Basin and sbobet elsewhere continued their pause in new drilling activity, according to the Baker...

Private oil and gas companies expected to push the Permian’s Delaware Basin to record output

- May 24, 2022

- EPUS Global Energy

- News

Oil and gas production in the Permian’s Delaware Basin will climb to record levels this year, according to research from Norwegian...

Permian Operators Colgate, Centennial to Combine in $7 Billion Merger

- May 20, 2022

- EPUS Global Energy

- News

Colgate Energy agreed on May 19 to combine with Centennial Resource Development Inc., squashing recent rumors that Colgate was seeking an...

Permian Basin Oil Output Forecast to Hit Record High in June: EIA

- May 19, 2022

- EPUS Global Energy

- News

Oil output in the Permian Basin in Texas and New Mexico, the biggest U.S. shale oil basin, is due to rise...

Shifting capital allocation strategies in E&P sector amid oil price up-cycle

- May 12, 2022

- EPUS Global Energy

- News

Russia’s invasion of Ukraine and the recent spike in oil prices has focused global attention on oil and gas supplies and...

U.S. oil producers increased capital expenditures and cash from operations in late 2021

- May 5, 2022

- EPUS Global Energy

- News

In response to higher crude oil prices, financial results for 42 U.S. exploration and production (E&P) companies showed large increases in...

Why Are E&Ps Slow To Respond To Higher Oil Prices?

- April 30, 2022

- EPUS Global Energy

- News

Find out what’s behind the muted response of North American oil drilling activity and how it compares with the recent rise...

Oilfield Water Markets Update, Trends, and the Future

- April 15, 2022

- EPUS Global Energy

- News

The Oilfield Services (“OFS”) industry has long been known for its cyclicality, sharp changes in “direction” and demand-driven technological innovation. One...

“Full-blown Energy Crisis” Started Long Before Russia/Ukraine War

- April 13, 2022

- EPUS Global Energy

- News

Tensions between Russia and Ukraine have thrown oil and gas prices into focus, but an energy crisis has been brewing for...

$100 Oil Is Back! Why Isn’t Texas Drilling?

- March 11, 2022

- EPUS Global Energy

- News

Russia’s war on Ukraine has made it practically patriotic to pump oil, but the Permian hasn’t ramped up production. Don’t blame...

There’s a new boom in the Permian Basin — wastewater

- November 30, 2021

- EPUS Global Energy

- News

In the Permian Basin, now the most prolific oil field in the world, hundreds of miles of plastic pipelines snake along...

Water Recycling Strengthens Permian

- October 30, 2021

- EPUS Global Energy

- News

For every barrel of oil produced in the Permian Basin, there are at least two barrels of water. In the Delaware...

Do Oil And Water Mix? The Biggest Energy IPO Of 2019 Might Answer That Question

- March 6, 2020

- EPUS Global Energy

- News

Saltwater disposal and integrated water logistics companies have attracted a higher proportion of the sparsely available capital flowing into the sector,...

Water management – Water and sustainability

- January 14, 2020

- EPUS Global Energy

- News

Environmental Sustainability and Governance (ESG)—get used to this term. It will be much more important to the oil and gas industry...

Continental Proves Its Primacy in Oklahoma’s SCOOP and STACK

- December 20, 2019

- EPUS Global Energy

- NewsSTACK/SCOOP

Oklahoma City, OK-based Continental Resources Inc. turned in a third-quarter earnings report that beat expectations across the board but results in...

Goodnight Midstream lands $500 million to expand oil field water operations

- October 8, 2019

- EPUS Global Energy

- News

Dallas pipeline operator Goodnight Midstream landed $500 million in private equity funds to expand the company’s oil field water operations. Tailwater...

Fund H20 finishes the Gun Barrel

- October 26, 2018

- EPUS Global Energy

- News

Fund H20 finishes the Gun Barrel on our Salt Water Disposal facility in the STACK/SCOOP.