The first step to understand an investment’s risk is to analyze the process from which the upside of the investment is achieved. In the case of EPUS Global Energy (EPUS), EPUS provides revenue derived from the processing of water in the oilfield. While most are familiar at some level with how the oil and gas business works, most are unfamiliar with how important its tag along, water is to the industry. The reality of the oil and gas business is that every well that produces hydrocarbons (oil and gas) is in fact a water well. The water is the transport that brings the oil to the surface so that it can be processed and sold.

In fact, water is by far the largest by-product of oil and gas production, and it comes with a responsibility. The oil and gas company needs to separate the water to get to the oil and then they must clean it up and put it back where it came from. If an operator fails to do that, his operations will be shut down, in the state of Texas if you are not producing or are shut in for more than 90 days the asset reverts to the land owner and mineral rights owner.

Similar to an apartment building, if you don’t keep the electricity turned on and the trash picked up you cannot rent the units. If you don’t rent the units, you have no income, and eventually a derelict building will be sold or demolished.

The vehicle most operators use to put the water back in the ground is called a Saltwater Disposal well, or they are referred to as SWD wells for short. Thousands of these wells support the oil and gas industry across the planet. In the case of EPUS they charge the operator for every barrel of water delivered to one of four SWD wells.

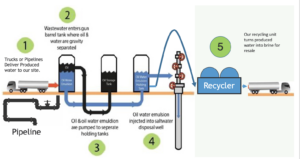

In essence, the process 1) removes the solids, 2) separates the residual oil and gas -and there’s always some-, 3) the remaining water is either injected into the well or recycled for further use, 4) while the separated or ‘skim’ oil is sold.

Without being nitpickingly technical, the following figure depicts the main parts of an SWD site, where the plain vanilla process goes like this:Water enters the site via pipeline or truck, from there it is put into a series of tanks. The first of these, often referred to as the Gunbarrel, separates the water from hydrocarbons. The process is relatively simple and utilizes gravity.

Oil rises to the top, water to the bottom. The oil is literally, skimmed off the top, hence the classification of skim oil. The smaller tanks store the oil until enough is accumulated for sale. This can be significant to the bottom line and represents a very low cost to the SWD operator.

From here the water is further cleaned up before it is either recycled into a clear brine for drilling and well completions or it is injected into the SWD well, essentially returning it to a depleted formation several thousand feet underground.

There are many variations to this typical layout, but the operating principles are the same across all SWD sites.

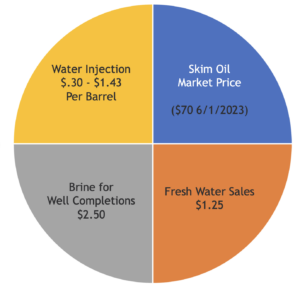

The economics upon which the SWD business is built on: 1) recovering as much oil as possible which is then sold, and 2) its ability to inject wastewater downhole at a consistent rate, charging ~$0.50 for every barrel of water treated.

In the case of EPUS they not only sell skim oil and inject water, but they also sell fresh water and utilize recycling technology to create a clear brine that they can sell back to the operator.

This greatly adds to the bottom line.

The key to a successful SWD operation is not what you might imagine. The technology is not overly complicated, the process is relatively simple, and the clients are predisposed to utilize SWD companies over creating their own infrastructure. The main differentiator in the business is location. Similar to buying real estate, you need to be in the right zip code, and as any good developer of real estate will tell you, you need to have the right relationships with vendors and clients and provide excellent customer service.

It is in this area that EPUS excels. The facilities built by EPUS are state of the art and provide an unparalleled experience for the client. EPUS works with some of the largest companies in the world to provide water services, this includes companies like BPX, ConocoPhillips, Devon, Chevron, Marathon, Occidental and Exxon (XTO), while providing some of the largest service companies including Western Midstream and Water Bridge access to their facilities as well. This insulates the company from some of the issues that plague the smaller operators in the oil gas industry and makes for a steadier income stream.

Most of the time investments like EPUS require either debt or private equity to build the facilities and they are not typically available to individual accredited investors. However, EPUS took a different approach, and it is paying off for investors.

With the changes brought about in investment law, primarily the 506c exemption, EPUS has been able to provide this opportunity directly to accredited investors, allowing them access to a program that provides an excellent first year tax incentive, monthly income and a share of the upside upon exit. EPUS created their Fund 2020 as a limited partnership to invest in water infrastructure.

A whole new group of investors has been able to take advantage of the upside of being in the oil and gas industry, without the risks associated with oil and gas drilling and operations. Regardless of whether the operator is selling their oil for $100 or $20, it comes with the same amount of water and that water must be cleaned and either recycled or put back in the ground where it came from, making EPUS a requirement of doing business for the operator.

EPUS also took note of the mantra, “location, location, location,” and has strategically positioned themselves in the Permian Basin, located on the border of Texas and New Mexico. This is the largest basin the United States and one of the largest oil and gas producing fields in the world. Their customer base includes some of the largest oil and gas producers in the United States and that customer base is anticipated to be producing in that area for the foreseeable future.

All in all, this makes EPUS’ Fund 2020 a solid buy for investors wishing to diversify out of the stock market. Because of the tax break associated with the first-year, advisors can also use this vehicle to help clients navigate the transition from IRA’s to Roth IRA’s or really to help offset any taxable event or reduce a client’s straight up W2 income.

As an example, an investor who bought a unit in 2021 and entered the investment as a General Partner, was able to reduce their taxable income by 85% of the investment. A unit costs $100,000 so effectively their income was reduced by $85,000. Depending on the individual’s tax bracket, that can reduce taxes significantly and help offset future taxes. As with any investment that provides a tax incentive, investors should consult with their tax professional to see if this would apply to them.

Additionally, Fund 2020 provides investors with monthly income based on the revenues received from skim oil sales, injection, processing and selling water. With two choices for investors an investor can either maximize income through the utilization of an A unit, or park money for future income through the B unit. Both units come with tax benefit outlined above.

EPUS has also built in an upside for investors. EPUS builds and manages these sites with the goal of selling the facilities and the associated business as soon as the market will bear a reasonable return. Depending on unit type, an investor can receive 10 or 30% of EPUS’ upside upon sale. Because the market will ultimately determine timing and price, it is hard to predict what that upside could be.

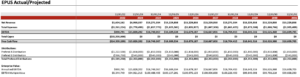

Looking at the numbers, EPUS’ Fund 2020 invests in the Permian Basin in Texas and performance has been impressive. In their presentation they show the following combination of actual numbers and projected. (Actual through April 2023)

There are some important assumptions.

- 50k a day permitted disposal over two facilities,

- 50 cents a barrel for trucked water,

- 63 cents for piped water with a low of 30 cents and a high of 1.49,

- $74 dollars for skim oil,

- 5 active pipelines,

- Exit assumes a 6x multiple

EPUS is also unique in their management approach ensuring they are on the same side as the investor. EPUS does not charge a management fee and stands to make millions upon the successful divesture of the assets at the right time. Investors stand to make significant profits if EPUS exits these investments well, and while EPUS waits for the right time to exit investors receive monthly distributions depending on their chosen unit type.

With oil and gas continuing to be the primary source of energy for the US economy for the foreseeable future companies like EPUS have a bright future. With careful management, see Jeff Johnson’s bio here, and a continued focus on what the future might hold EPUS should perform well for investors.

To find out more about Fund 2020 and EPUS, contact your advisor or call EPUS directly.

Declaimer:

Statements, other than statements of historical facts, stated above address activities, events or developments that Epus Global Energy, LLC (“Epus”) anticipates will or may occur in the future.

These forward-looking statements include such things as estimated returns on investment, oil and gas reserves, estimated recoverability of oil and gas reserves, oil and gas prices, well drilling and completion costs and budgets, environmental conditions, weather, quality and timely delivery of equipment and materials to the wellsites, regulatory compliance, tax treatments, competition, management expertise and other similar matters. These statements are based on certain assumptions and analyses made by Epus in light of their experience and their perception of historical trends, current conditions and expected future developments.

However, whether actual results will conform with these expectations is subject to a number of risks and uncertainties, many of which are beyond the control of Epus, including general economic, market or business conditions, changes in laws or regulations, the risk that the well is productive but does not produce enough revenue to return the investment made, the risk that the well is a dry hole, uncertainties concerning the price of gas and oil, and other risks. Thus, all of the forward-looking statements made in herein and its exhibits are qualified by these cautionary statements. There can be no assurance that actual results will conform to Epus’s expectations.

Tax disclosure:

IRS Circular 230 Notice

To ensure compliance with requirements imposed by the IRS, we inform you that, any information contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code, or (ii) promoting, marketing, or recommending to another party any tax-related matter addressed herein. EPUS Energy does not offer legal or tax advice. For legal or tax advice concerning your specific situation, you are encouraged to consult with your attorney, accountant, or tax adviser prior to making any decision involving the purchase, surrender, exchange, replacement or sale of an investment and whether it is suitable for your particular financial goals and objectives.