Russia’s invasion of Ukraine and the recent spike in oil prices has focused global attention on oil and gas supplies and investments from industry players in fossil fuels.

As many oil and gas companies have started to reshape their portfolios and shift priorities to diversification, resilience and decarbonization, only a few are positioned to react swiftly to the recent oil price surge to provide much-needed additional production. Even shale producers may not be able to produce a short-cycle response due to potential supply chain bottlenecks.

New oil price cycles historically affect investment levels, with oil and gas companies also forced to adopt new strategies and reset priorities to remain competitive and attractive for investment.

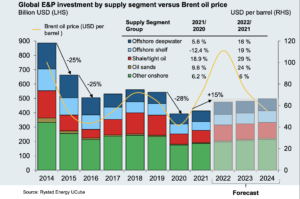

The current upcycle – which has seen Brent crude surge past $100 per barrel following Russia’s invasion of Ukraine in late February – is remarkable in that, despite the oil price surge and robust cash flow generation, exploration and production (E&P) investment is only showing a modest uptick, with little sign of a recovery to levels seen before the Covid-19 pandemic kicked off in early 2020.

This indicates that there has been a fundamental change in how oil and gas companies are approaching the investment allocation process.

In this white paper, we look at how industry players are positioned to react to the current oil price upcycle by unpacking substantial additional investments in the upstream sector.