Sprott Energy Strategy,

March 2018 Commentary

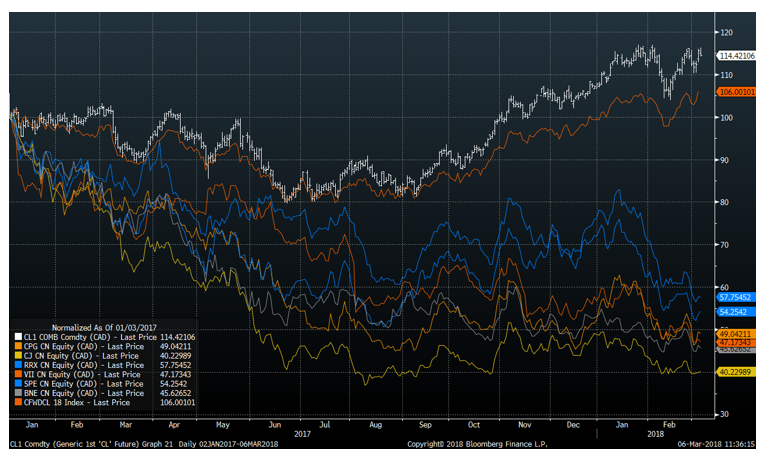

How can one of the most lucrative investment opportunities in decades stare investors in the face and yet month after month energy stocks have continued to languish while the market’s focus stubbornly remains on other areas like bitcoin, marijuana stocks, and the general tech space leading to an unintentional shunning of the energy sector? Every morning on CNBC and BNN significantly more airtime is given to discussing in-vogue names like Amazon or Canopy Growth than the $2.3 trillion oil market or the energy stocks which have dislocated from the price of oil by the greatest extent in history while oil trades at multi-year highs (see below…oil spot/strip price in CAD$ terms is up 14%/6% since the beginning of 2017 and many Canadian oil stocks are down 50%-60% over the same time frame = 65%+ relative underperformance!!!).

Source Bloomberg

What makes this lack of interest (and commensurate lack of investment flow) so frustrating? It is that the current macro backdrop for oil is overwhelmingly positive in addition to our belief that oil is in a multi-year bull market with few things capable of interrupting this reality. Why can’t everyone see what we see?

1. Oil is trading near a 4 year high