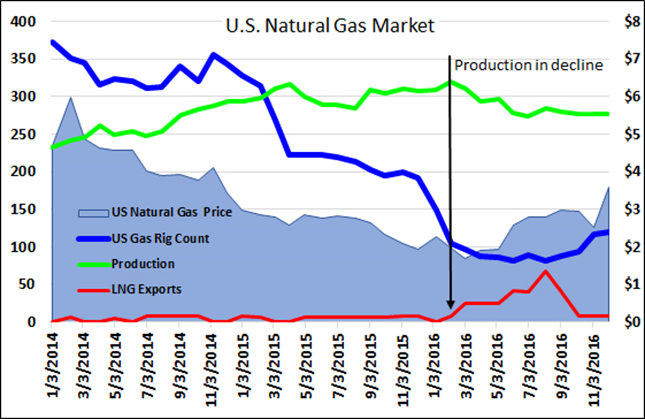

BHI recently reported that the U.S. natural gas rig count had Agen Sbobet increased to 145 rigs, up a total of 24 rigs from the same time last year (see the chart above: blue line on left scale). Unsurprisingly, the gas rig count is also generally well correlated to the natural gas price (with an R-squared value of ~57%), which currently stands at $3.18 per MMBtu (Henry Hub), versus $2.27 a year ago (the blue shaded area on the chart on right scale). Where things start to get interesting is when we look at U.S. gas production (see chart: green trend line – not to scale).

As the gas rig count fell from a peak of 370 or so in 2014 to about 88 in early 2016, the average monthly gas production (source: EIA) began to fall after plateauing in the 91-92 Bcf per day range in April of 2015. Since then, gas production https://epusenergy.com/sbobet/ has shown a decline to about 87 Bcf per day (about a 5% drop since the peak), where it currently stands. The rig count over this period has since recovered from 88 to the 145 where it stands at today, but this increase in the rig count over the last six months has yet to increase the production rate and may only be slowing the decline so far – at least that’s what the numbers suggest.

While this rebalancing of the market has been going on, long-awaited LNG exports from the U.S have started to kick in (red trend line on the chart above – definitely not to scale), and reached https://academipress.com/sbobet/ a recent peak of around 27 Bcf for the month of August 2016. This represents only about an equivalent of 1.5% of one month’s production, but when you add it to the 200 Bcf per month or so that is exported by pipeline to Canada and Mexico, then the numbers are slowly starting to add up.

LNG Exports Starting to Bite

The point here is that LNG https://kirbybreefitness.com/sbobet/ exports have started to take a small bite out of total production. The reason for this is the price differential between U.S. natural gas prices and those that can be obtained elsewhere. Gas prices this week currently stand at $3.18 per MMBtu in the U.S., $5.16 per MMBtu in Europe, $6.44 per MMBtu in the UK, and LNG is at $7.15 per MMBtu in Japan. Gas has always struggled to become an efficient global market because it is hard to transport, and creates infrastructure challenges for countries who wish to utilize natural gas imports.

Black & Veatch recently reported in their 2016 Natural Gas Industry Report, that survey https://millersoils.nl/sbobet/ respondents expect that a proliferation of new LNG facilities will drive down global prices, and help to stabilize the market and increase global production.

Reuters also reported this week that traders sending U.S. LNG exports to Asia were able to fetch $10 per https://www.aydinemlaktrabzon.com/slot-anti-rungkad/ MMBtu due to tightening in the market and that LNG traders are currently ‘netting’ US$1 million-plus per U.S. –> Asia cargo. The three biggest importers of LNG in the world today are Japan, South Korea, and China, with India and Taiwan not far behind.

Since faster than expected growth in demand is coming from Asia amid delays and outages at new export sites, then the current arbitrage opportunity may continue to exist for some time yet. Again, per IDN Poker Reuters, there is still plenty of LNG capacity available to cater to increasing demand. If U.S. LNG exports gather pace and continue to bite into this capacity then this will tend to help keep domestic gas prices in the firm to a higher range, especially if current gas production levels taking some time to recover.

Looking at the https://millersoils.nl/idn-poker-online/ EIA Weekly Natural Gas Storage Report, current storage levels are ticking along at about 20 Bcf below the 5-year average mark, but it should be borne in mind that this is after a period a few years of setting new highs for storage levels. Last week’s storage levels were 11% lower (338 Bcf) than at the same time last year. Nothing significant going on here yet, and everything should be expected to balance out as new production from the increased rig count kicks in and recovers the small decline in production over the past few months. (By Chris Chia, OilPrice.com)